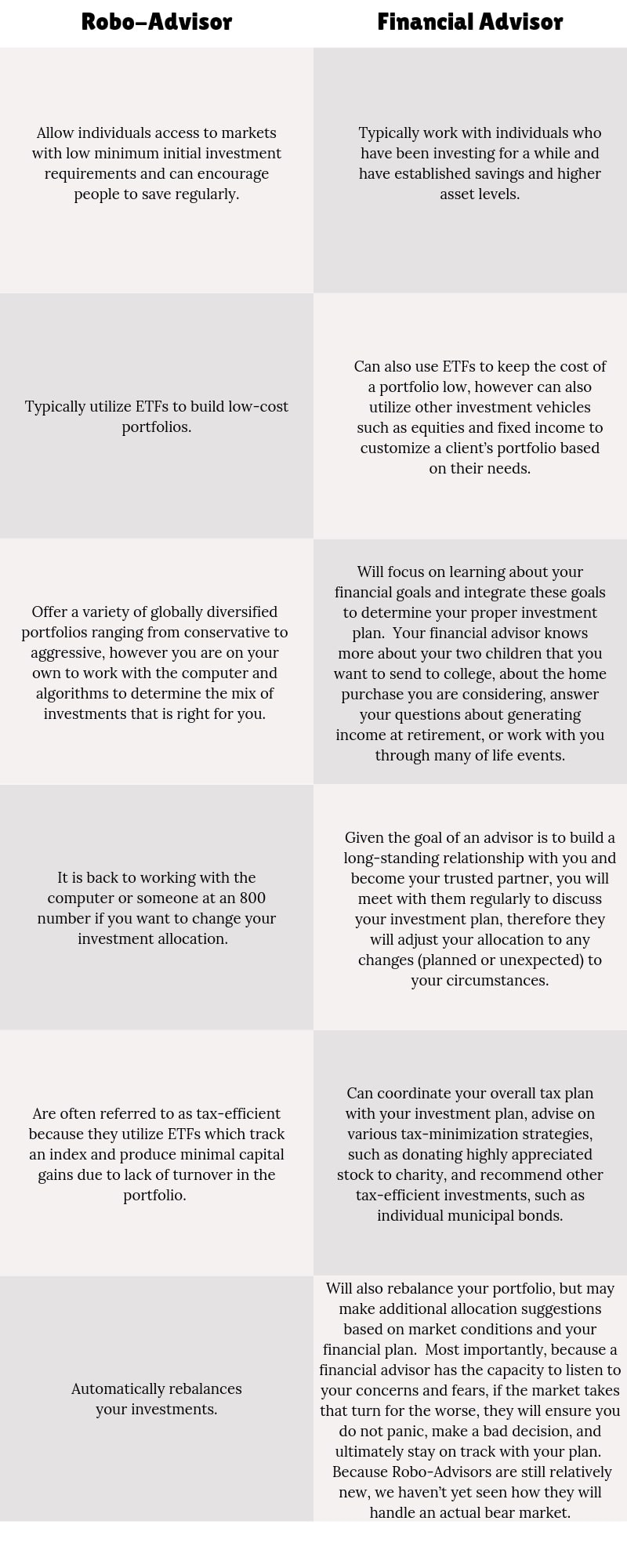

Today’s investor is faced with many choices when it comes to how to manage their portfolio, a blessing that also comes with many challenges! One of these options is that of the Robo-Advisor; an online, automated investment service that uses computer algorithms to manage a series of pre-defined portfolio allocations and involve little to no human interaction.

Is a Robo-Advisor right for you?

Robo-Advisors offer a number of benefits to today’s investor and have opened up portfolio management to a whole new group of people looking to get started with investing. However, the question is – is a Robo-Advisor right for you? While Robo-Advisors offer a low-cost investment solution to today’s investor, as you move forward in life, acquire wealth, and develop specific financial goals, your portfolio and financial plan may need more attention and the guidance that only a human financial advisor can provide.

Our focus today will be to explore the features of Robo-Advisors and compare them to what a financial advisor can provide.

Comparing Robo-Advisors and Financial Advisors

Robo-Advisors can help get you started but will they get you across the finish line? Will that Robo-Advisor know how to accomplish your goals and tailor your plan to your particular needs? That’s where personalized financial services can make all the difference. Please contact us if you would like to learn more about working with a financial advisor and if this is the best option for you.