What we do / Wealth Management

While portfolio assets are a part of wealth management, your financial plan is much more than just money management. The team at Peninsula Wealth will partner with you to manage every aspect of your financial life.

What’s next…

Our team will work with your family to guide you through the process of creating, building, and evolving a holistic financial plan that is tailored to your unique situation. Our expertise across financial topics like planning for retirement, optimizing your investment strategies, and minimizing both your risk and taxes puts us in a unique position to meet your financial needs at every stage of life and accommodate both your near and long term goals.

Our wealth management services take into consideration your life events and include specific financial planning services like:

- Retirement planning

- Equity compensation planning

- Investment strategies

- Tax minimization strategies

- Estate and legacy planning

- Risk management

- Charitable giving

Your holistic financial plan can also help you navigate many of life’s events like:

- Helping a child or grandchild with their education

- Leaving a legacy

- Changing jobs or careers

- The loss of a spouse or change in family makeup

- Need for long term health care

A flexible and well-built wealth management strategy will not only anticipate many of these life changes but will help you navigate those that arise on the fly. Peninsula Wealth will be your partner through the expected and unexpected as well as the ups and downs of the market. We’re here to see you through.

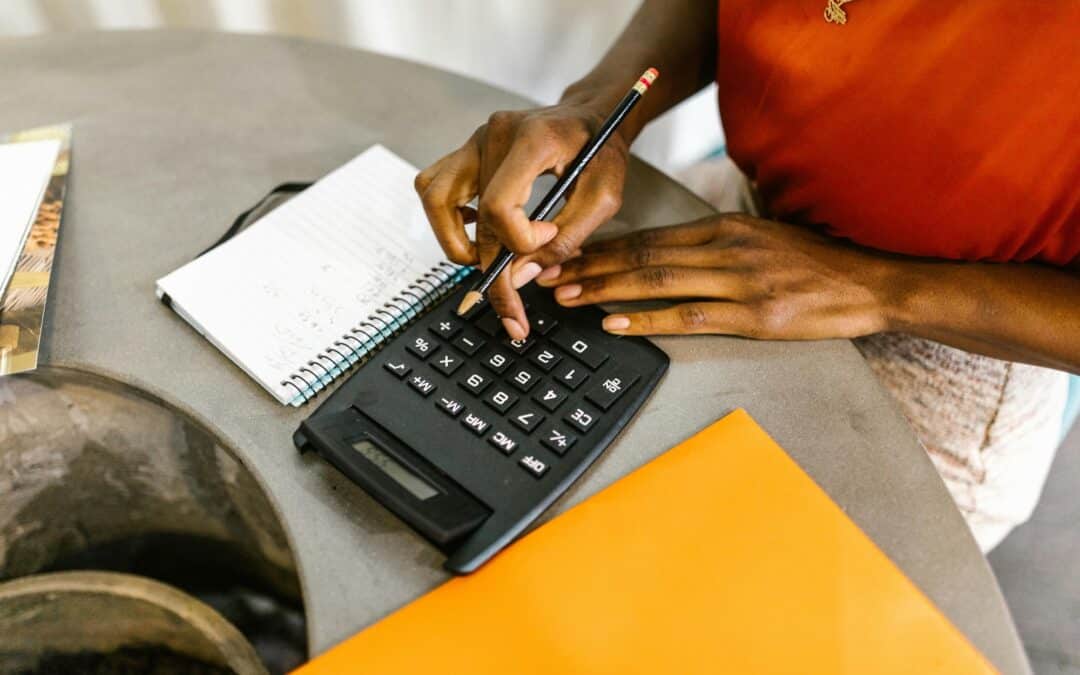

Financial Planning 101: Cash & Debt Management

Part of an effective financial planning strategy is a regular review of your assets and your debts. Knowing where you are with strategic savings goals, budgeting, and debts can help your financial planner understand how to think about your finances in the near future...

Why Budgeting Matters to Wealth Management

While financial planning and wealth management are about a lot more than how you spend your day to day dollars, tracking your spending and budgeting for your goals is an important part of making sure your financial plan is aligned to your particular needs – and to your long term plan.

Wealth is the ability to fully experience life.

–Henry David Thoreau

Stay connected