Insights

Regular articles, videos, and information from the Peninsula Wealth team. Sign up for our newsletter for regular market information and updates from the team!

Balance Your Retirement Investments With More Comprehensive Risk Analysis

"Eat well or sleep well" is a common refrain you may have encountered over the course of your financial planning journey. This phrase refers to the risk-return tradeoff that investors face when it comes to allocating their resources. The type of portfolio one owns...

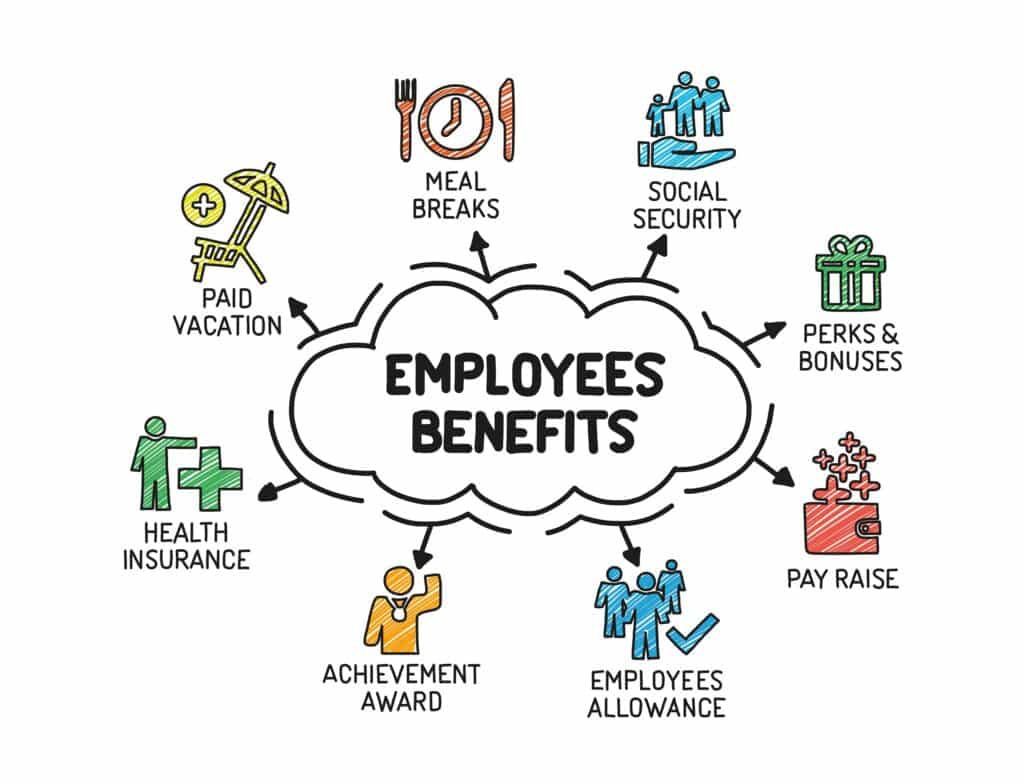

Get the Most Out of Your Employee Benefits

Every dollar counts in this highly-inflationary economy. When it comes to managing personal finances, employee benefits are often overlooked as a potential source of savings. Many choose to simply re-elect last year’s workplace benefits without giving them a second...

A Simple Guide to Roth IRA Conversion

As the Baby Boomer and Gen X generations reach retirement age, many are taking another look at their retirement savings plans hoping to identify opportunities for tax reductions. For those with tax-deferred plans like traditional IRAs and 401(k)s, Roth conversion...

Funding Your Child’s Education

When it comes to saving for your child’s education, the earlier you can start, the easier it will be to reach your goal. A modest contribution today could amount to a larger sum by the time your child is ready for school. Let’s take a closer look at a few of the different education savings plans available to you.

What You Should Know About Medicare

As you age, the threats to your health will likely become more prevalent. Your body will become more vulnerable to illness and physical deterioration, which could lead to a rise in healthcare expenses from medications, doctor visits, physical therapy, ambulance rides, and more. If you’re looking to get ahead of these future expenses and lessen the burden you’ll be forced to shoulder down the road (and you qualify), utilizing Medicare may be an excellent option for you.