When considering an investment strategy, it’s important to weigh the balance between risk and return. In the world of finance, risk is defined as the variance from expected returns, so an investment whose returns are not likely to deviate from its expected return is considered not risky. On the other hand, an investment whose returns vary widely and sharply in either direction is said to be risky. Thus, investment risk is the chance of positive and negative returns and intrinsically the price investors pay to earn potential outsized returns for taking on the risk. But that does not mean investors should take unnecessary amounts of risk to receive returns. Over at Peninsula Wealth, we help our clients build diversified investment portfolios to take on the least risk possible to align with the returns they seek to achieve their near- and long-term goals.

Even though everyone has a different risk appetite for volatility, it is important to understand the trade off’s between owning a high or low risk portfolio. For instance, if you’re keeping your money in a standard savings account or money market account, the risk is that you may fall behind the market, and most notably, lose to inflation. With other investments, like equities and alternative investments, you might lose everything. It’s a wide spectrum and only you can determine how much volatility you’re willing to stomach. So, to start gauging where you fall on the risk tolerance spectrum, ask yourself a few hypothetical questions:

- If I had $100,000 invested and tomorrow it dropped to $50,000, how would I respond?

- In periods of economic volatility, how often do I think about my portfolio?

- How long do I need to invest my money in a particular asset before I see a return? (i.e., how long will I need to be without this money?)

- What timeline do I have for my financial goals?

How do different investment vehicles stack up when it comes to risk and reward?

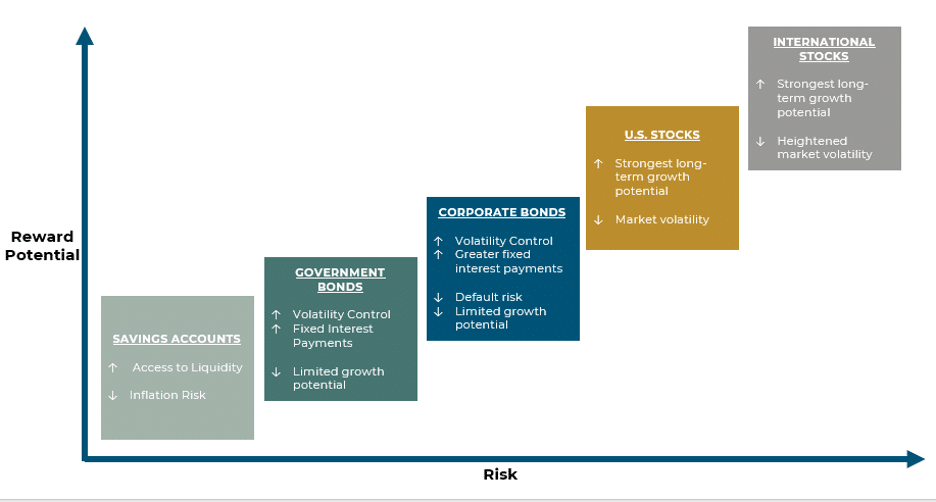

Different investment vehicles carry different risk profiles, and it helps to see which types align well with your own tolerance.

Here’s a quick breakdown of common asset classes and where they generally fall in the risk and reward spectrum

Is your investment portfolio well-balanced?

As seen in the illustration, assets closer to the center of the axis are considered less risky and volatile but their reward potential is limited. As you move further along the risk spectrum, the reward potential continues to climb. At Peninsula Wealth, we believe the best way to manage the dichotomy between risk and return in investing is to build a diversified portfolio using a calculated mix of all asset classes dependent on your risk tolerance, objectives, and time horizon. Since many assets are imperfectly correlated with each other, when they’re combined in a portfolio, their differences in returns and losses results in a portfolio that is less volatile but also maintains some exposure to risk for growth opportunities.