To me, fixed income investments often feel like the Rodney Dangerfield of the investment world in that they “don’t get no respect…” We spent the last few years in a low-rate environment defending the place of fixed income in well-diversified portfolios (given the relative gains in the stock market), now we are defending those same holdings in a rising interest rate environment – you can’t win right? I think it may make sense to take a step back and review the reasons we hold fixed income in well-diversified portfolios.

The Basics

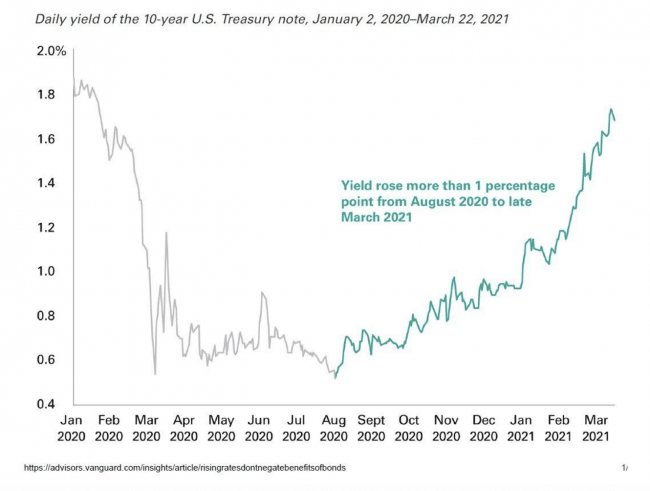

First the basics: recall that there is an inverse relationship between bond prices and interest rates. When interest rates fall, the prices of bonds rise. Conversely, when interest rates rise, bond prices generally will fall. Recently, intermediate and longer dated bond yields have risen. As an example, the 10-year US Treasury bond yield increased 100 basis points (1.00%) from August 2020 through the end on March this year as illustrated in the graph above.

Given the rate rise illustrated, most intermediate and long dated bonds, bond mutual funds and exchange traded funds (“ETFs”) lost money during this period. So why continue to hold bonds when we expect rates to rise over the next few years? There are a couple of things to point out:

- The main component of total returns on a bond portfolio is the interest component rather than any increase in the bond’s market value (we will save a discussion on bond yields and inflation for a later blog post.

- Bonds aren’t just held for their return characteristics. We hold municipal bonds for their tax advantage, but more importantly, bonds are held to dampen a diversified portfolio’s volatility over time

Perhaps a good illustration of point #2 would be the returns of stocks and bonds over the last two large market moves. During the Global Financial Crisis in 2008 worldwide equity returns averaged a loss of close to 34% while global fixed income returns generated a gain of 8%. Similarly, during the depths of the Pandemic crisis last year, equities were down 16% from January 2020 through March 2020 while bonds returned 1%. Finally, according to Vanguard Research, over a longer time frame – January 1988 through November 2020, monthly fixed income returns where positive in 71% of the months where monthly equity returns were negative 1.

Rising Rates

While rising rates do cause some negative impacts to a bond portfolio, there are upsides depending on the investment vehicle you choose. We prefer to use individual bonds whenever feasible rather than bond mutual funds or ETFs. The rationale is we can tailor the income streams based on client needs, and, as bonds mature, we have the opportunity to invest those proceeds in higher yielding bonds. With mutual funds and ETFs, the fund manager generally must maintain a duration in accordance with the fund’s prospectus, thus potentially exposing the portfolio to more principal risk. Additionally, there is no way to forecast future income flows, thus the ability to customize is more difficult.

If you have any questions on this or other financial planning topics, feel free to contact us.