This post was written by Bob Keane, CFP® – Financial Advisor in November 2021 and updated in May 2023.

Back in 2021, we shared a primer on the debt ceiling in response to the Senate & House agreeing to a temporary increase in the Federal Debt Ceiling of $480 billion to facilitate US Treasury borrowing.

Flash forward to 2023 and we’re dealing with the same patterns we’ve been seeing for a number of years. Without getting into politics, it seems odd to me that this continues to be an issue when appropriations bills are passed by both Houses and the Executive branch on an annual basis.

What is the Debt Ceiling?

The Debt Ceiling or Debt Limit has been with us since 1939. Prior to then, Congress generally authorized debt in accordance with specific authorized spending. The Debt Limit (“Limit”) effectively places a cap on the amount of debt the US Treasury (“Treasury”) can issue to fund expenditures. Initially, Congress would increase the Limit whenever appropriate and before the Treasury ran out of borrowing power. This changed in early 2002 when we hit the Limit and Congress did not automatically increase it. For the first time, Treasury had to take “extraordinary measures” (get used to hearing this term over the next month or so) to continue to pay our bills. Extraordinary measures typically include withholding payments to government trust funds and other actions until a new Limit is authorized and those trust funds are reimbursed for the missed payments.

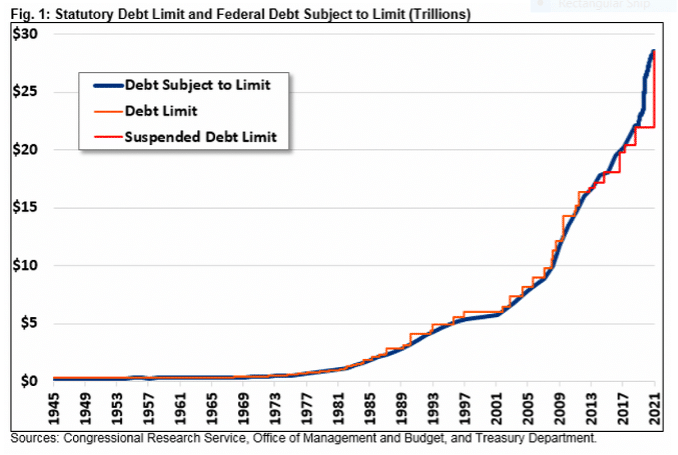

Since 2002 it seems Congress continually fights over the Limit and often tries to use it as leverage for a number of issues, usually around the federal appropriations bills that need to be approved as the fiscal year for the Federal government runs from October 1st to September 30th. That said, Congress has always (eventually) raised the Limit. See the graph below to see the historical debt vs. the Limit:

So, what happens if Congress doesn’t increase the Limit? If federal revenues can’t cover existing expenditures (which they can’t at this point) then the US goes into default on its obligations. You will hear and read a lot of bad things will happen if this comes to pass. At a minimum, it is likely US Treasury debt will be downgraded by the credit agencies, and like a corporate bond downgrade, borrowing costs will rise. Given that so much consumer debt (think mortgages) is tied to US Treasury rates, it seems plausible that interest rates will rise overall.

Government Shutdowns, Debt Defaults

While a debt default and government shutdowns are often lumped together, and deservedly so, there are some distinctions that are important.

The US government has shut down in 4 instances since 1995 with the longest shutdown being 35 days in December 2018/January 2019. These shutdowns were principally due to federal funding appropriations bills not being passed rather than Debt Limit issues. Appropriations bills pay for funding for the upcoming fiscal year and if not enacted, measures are taken to cut all spending that isn’t covered by mandatory spending measures (an example of mandatory spending that continues would be current Social Security payments). In a government shutdown, generally workers are furloughed, and we tend to see some disruption in government services (examples being TSA, air traffic controllers, passport processing, etc.).

The US Government has NEVER defaulted on its debt! While I mentioned the minimum that might happen earlier (higher interest rates for all), things could likely be worse. In a default, many more creditors of the US government would not be paid than in a shut-down. A default could shut down payments to those receiving mandatory benefits, interest & principal payments on US debt, etc. So I guess there are some pretty good reasons why Congress continues to increase the Debt Limit…

So, what do I do?

Uncertainty and the markets are like oil and water. The longer Congress debates the Debt Ceiling (and appropriations bills), the more likely we will see continued market volatility. That said, we believe Congress will get its act together and authorize a higher Debt Ceiling taking some uncertainty out of the equation. Make sure you are comfortable with some volatility in your portfolio, if not, please reach out to your financial advisor to discuss possible options.

If you’d like to learn more about these topics, I’ve included a couple of links I found very useful: