This post was written by Bob Keane, CFP® – Financial Advisor

This is the year I promised myself not to do the same old thing when it comes to open enrollment. Like many others I’m sure, I have always just picked the same health plan as I did the prior year. But open enrollment is a great time to reassess possible changes you may expect in the future and put in policies to plan ahead or to save you money. Expecting more medical surgeries next year? Starting to head back into the office soon? Welcomed a new child and so you need to up your life insurance policy? Below we break down some of the options that may be offered by your employer and provide some practical advice.

Retirement Plans

While the days of pensions are over for the most part, most employers continue to offer some type of retirement savings plan. In most cases, you can change your contribution amounts at any time during the year, but open enrollment is a good time to assess what you are doing. We generally recommend contributing the maximum allowable (if you can afford it) and keep in mind that the contribution limits for 2022 will increase $1,000 to $20,500 if you are under the age of 50. For those age 50 and over, you can contribute an additional $6,500 bringing your total salary deferral to $27,000. For those that cannot contribute the maximum, at a minimum make sure you are contributing at least the amount that your company matches, it is “free” money that you really do need to take advantage of.

Some companies also allow for after-tax contributions to a Roth 401k plan. These are subject to some additional limitations so please contact your financial advisor to see if you can take advantage of this option.

Finally, now may also be a good time to check the asset allocation of your retirement savings account(s) – is the account allocated appropriately given your retirement time horizon and risk tolerance? Also, your asset allocation may have drifted from your target due to market conditions over the past year or two. If so, there is no time like the present to rebalance the account back to your target allocation. You also check with your plan sponsor to see if there are any automatic rebalancing options available, that way you’ll be more likely to stay close to your target allocation. Keep in mind that plan sponsors often add/delete investment choices so take a look to see if any new funds may be better than your current selections. Feel free to reach out to your financial advisor to assess the funds available for best fit.

Health Care Plans

As I mentioned earlier, this is where folks usually just select the same plan as the prior year but this may not necessarily be the best plan for your household. While many people focus on the monthly premium cost, a better way to select the best plan would be to look at all costs associated with the plan. What are the co-pays, deductibles, total out-of-pocket limits, and the premiums. A good approach would be to dig out your prior year expenditures and look to see if there may be some benefit to switching plans. Obviously costs are not the only component, coverages sometimes vary and take care to ensure your doctors participate in the plan you select.

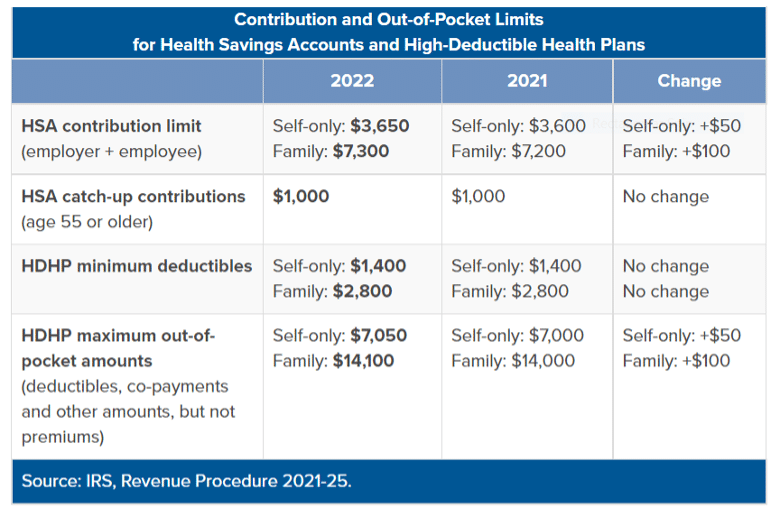

Your employer may also offer a HDHP (High Deductible Health Plan) that may make sense after doing your “all in” cost homework. When paired with a HSA (Health Savings Account), this could be a smart choice, particularly if you are younger and in good health. An HSA is one of the only vehicles where contributions to the account are pre-tax, income from the account is tax-free, and the account can be rolled over from year to year (unlike a FSA). Below are the limits for HSA’s and HDHP for 2022:

Insurance

Many employers also offer some level of insurance such as life, disability, accidental, etc. Determining how much insurance one needs is a topic for another day but many employers cover the cost on a small amount of term life coverage with additional coverage available to the employee for an additional premium. Disability is definitely something one should consider given our human capital is one of our most important .

Other Supplement Benefits

There is a wide array of supplement benefits that an employer may offer (or not) but below are a couple that may be worthwhile depending on your situation.

- Pre-paid legal plans – usually available for a small monthly charge, but look into the fine print as some services may not be covered (example – a will may be covered but executing a living trust may not be)

- Tuition reimbursement plans – for those with continuing education requirements or other plans to attain a degree

- Commuter benefits – we may not work from home forever, these plans may be funded with pre-tax contributions that may save you some money for mass transit, parking, and potentially more at tax time

- Deferred compensation plans (“DCP”) – some companies also offer deferred compensation plans. This allows you to take some cash compensation and contribute to a DCP. Benefit being you will not pay taxes on the deferred comp (including any investment gains) until you withdraw it – presumably in retirement when you may have a lower marginal income tax rate. Downside is the deferral is not guaranteed in the event of a company bankruptcy

Open enrollment is something we should all spend a little more time on each year. While this is not a comprehensive article, hopefully it provides some actionable advice to take into the process with you. Good luck!