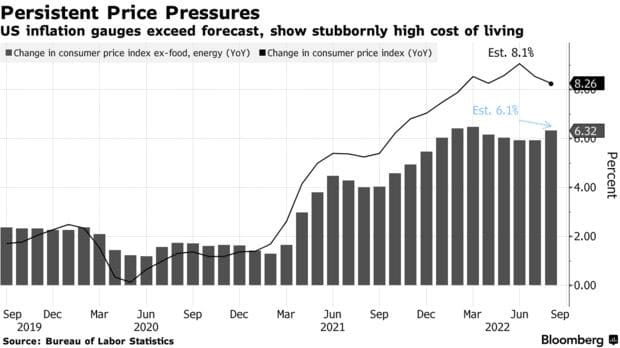

Earlier in the week the Federal Reserve announced a 0.75% rise in short-term interest rates, bringing the funds rate target to 3.25%. This was in reaction to news consumer prices were not coming down as expected. This is the fifth rate hike this year, and the third of this size. We expect similar rate increases to target 4.375% by the end of 2022 and 4.625% in 2023.

Why does the Fed believe rising rates will temper inflation? The theory is the current high inflationary period is driven by a mismatch in supply and demand. Demand for goods and services have been very high. The supply side has been unable to keep up, plagued with labor shortages, factory shutdowns, and transportation woes. The Fed has no control over the supply side, but they can tamp demand by raising interest rates. The hope is businesses and households will feel the pinch of higher borrowing costs. In theory this should translate into less spending and lower prices.

Persistent Price Pressures

We expect market volatility to continue into 2023 as investors are unsure whether the Federal Reserve can execute a soft landing and bring down inflation. In addition, international supply chain bottlenecks, U.S. elections, energy crisis in Europe, and the Ukrainian-Russian war continue to add to the uncertainty.

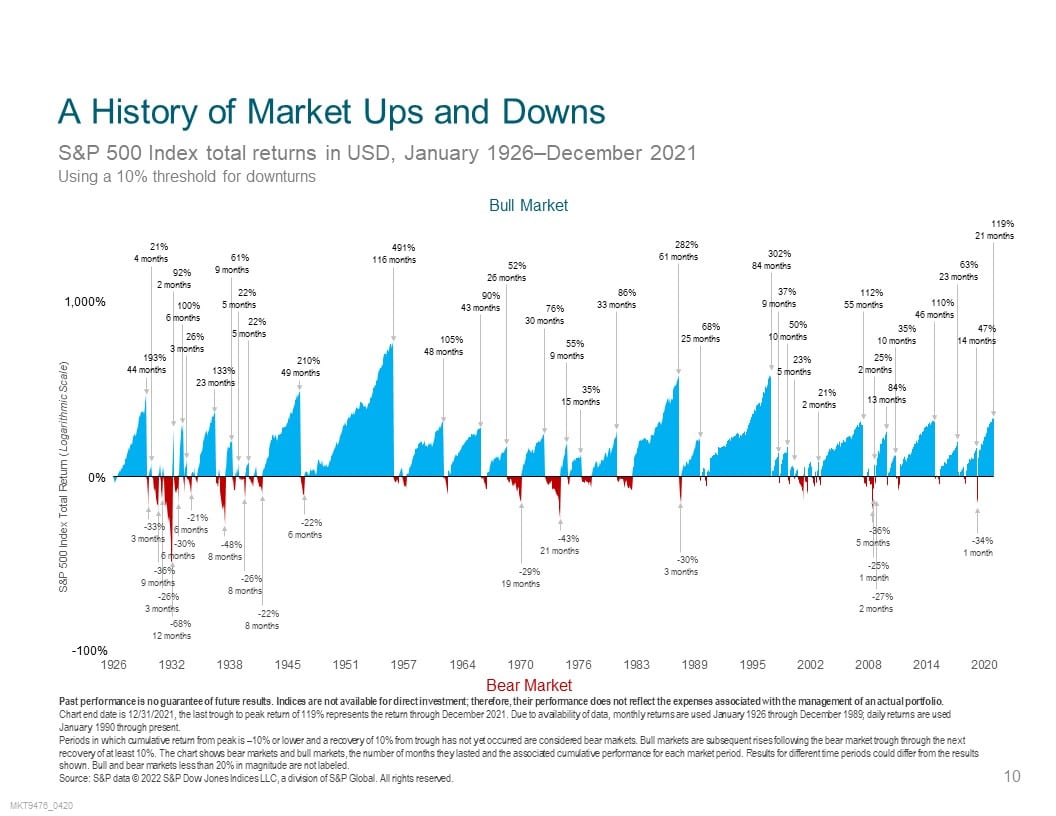

As we prepare for more volatility, and the possibility of a recession, we would like to gently remind you to focus on your long-term plan. Trying to time the market has been a proven losing long-term strategy. Please refer to the attached piece from our partners, Dimensional Fund Advisors, on the historical returns following periods of a recession. While past performance is not an indication of future performance, the long-term data shows that recessions are typically short lived when compared to periods of expansion.

A History of Market Ups & Downs

Below are the key points we advise all of clients to review now:

- Do you have 12-18 months of expenses in a high-yield savings account? Savers can now earn some meaningful income in a basic savings account.

- Is your allocation between stocks and bonds aligned with your risk tolerance? It is important to make sure you can stomach periods of volatility so that you can stay the course and resist the urge to make costly knee-jerk reactions. This could be a good opportunity to get more conservative.

- If you’re looking to sell some concentrated stock positions with embedded gains, it could be a good time to harvest losses from RSUs or other legacy positions so that the tax impact is lessened.

Please let us know if you would like to discuss any of the above, you may schedule a time to connect with us here.